Dynamics of mortgage interest rates in the USA

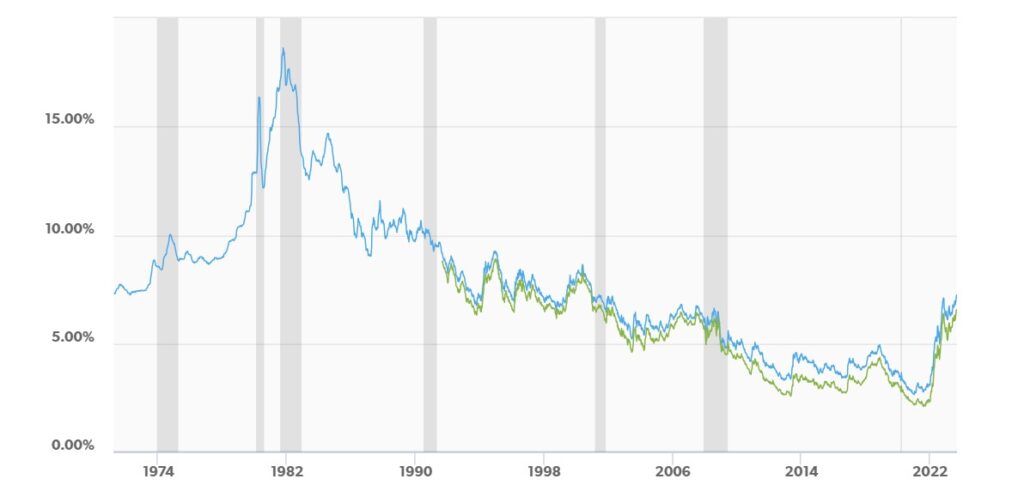

Just like any other asset class mortgage interest rate depends upon demand-supply and macroeconomic factors, the average mortgage interest rate for the last 30 years is around 7.2%. We constantly witness interest rate fluctuations due to FED (Federal Reserve) announcements and other government policies. Let us have a look at the average mortgage rate for the last 30 years.

We can clearly see mortgage rates making a high of around 18.5% in the 1980s and hitting a low of 3.5%. in 2020-2021 (Data taken from Freddie Mac Primary Mortgage Market Survey) . We will try to understand the reasons behind this fluctuation in this article.

Economic factors affecting mortgage interest rate

Inflation

Inflation refers to the gradual increase in the price of goods and services with time. Inflation weakens the purchasing power of the money over time. To understand the effect of inflation on mortgage rates you have to think from the perspective of a lender. As a lender, in order to be profitable and sustain in the market you want to beat inflation otherwise what’s the purpose of lending? Thus, the mortgage rate is usually always higher than the inflation rate.

If inflation is high then FED raises interest rates to bring inflation down which in turn raises the cost to borrow money. (Because lending rates are always higher than interest rates). This scenario will make mortgages more expensive and decrease the demand for property.

Government policies

The government regularly makes policies to control the economy. The government usually controls the mortgage rate with the help of a national bank which is FED in the case of the United States to achieve economic targets like employment and inflation.

Federal Reserve’s monetary policy is set by Federal Open Market Committee (FOMC) which meets eight times a year and releases a policy statement. FED decisions and mortgage rates have a very strong correlation (generally positive correlation means mortgage rates follow FED rates).

The government can also control mortgage rates in the following ways:

· Incentivizing a particular land use and introducing zoning reforms. It can even relax certain regulations to facilitate more demand.

· By providing tax benefits to builders to encourage investment in the real estate sector. Such schemes bring down the operational cost of sellers thus reducing overall pricing.

· The government can also introduce income groups targeted schemes like for homeless people or low-income group people with low down payment requirements or lower interest rates.

These are just a few examples of government policies that can alter mortgage rates. The government has many more ways and strategies to control mortgage rates.

Demand-Supply

Demand-supply principles are valid in the case of the housing business and mortgage rates. When demand is high and supply is low, prices rise, and when demand is low and supply is high prices fall until equilibrium is attained. This is one of the most basic principles of economics. In the housing market also buyers create demand and real estate investments create supply.

Real estate as an asset class is highly illiquid in nature. It takes a long time to create supply as real estate building has its own inherited constraints. Also, the transaction value and time are also higher.

Lower interest rates trigger higher demand in the real estate market. When interest rates fall, people are lured to take mortgages. As more interest buyers approach lenders, the demand rises which in turn could either lead to a rise in mortgage rates or trigger new construction. While, in case of events like natural disasters or pandemics real estate witnesses lower demand.

Global events

The global event can also affect mortgage rates e.g., the Ukraine-Russia war has created fear among investors making them shift to safer asset classes like bonds. With the increased demand for bonds, their prices rise and yield decline. Mortgage rates also follow similar trends.

Financial market

Though there is no direct relation between the stock market and mortgage rates both follow the basic movement of the economy. When there is fear in the market, investors park their money much safer bond market as it guarantees return while stocks may witness a sudden crash. As the demand for bonds and securities increases their prices rise and yield falls.

Mortgage loans are also sold in the secondary markets converting them into bonds known as mortgage-backed bonds. When the demand for these bonds is lower their prices are also lower and yield is higher so the mortgage interest rate is also higher. However, if the demand for these bonds rises, their prices also rise leading to a decline in yield and mortgage interest rates.

Personal factors affecting mortgage interest rate

We have so far discussed the factor that are beyond the control of buyer. You cannot do anything about inflation, government policies or global events. Now we will focus on those factors which are under control of the borrower.

Credit score

To get the lowest mortgage rate you need to have a good credit score. A credit score above 700 is considered a good credit score. And credit score below 630 can create problems for you.

Credit score | Remark |

300-579 | Bad |

580-669 | Fair |

670-739 | Good |

740-700 | Very good |

800 and above | Excellent |

Mortgage rates have an inverse relation with credit scores. A bad credit score may increase your mortgage by as much as 1% or even disqualify you from certain lenders.

Home location

Mortgage rates in the US vary between states. The difference in average rates may be as high as 0.7%. The main reasons behind these rate differences are varying mortgage default risk, early payoff risk, different foreclosure laws, changing operational costs, and different levels of competition in every state.

Loan-to-value ratio

Loan-to-value ratio (LVR) is a key parameter used by lenders to assess mortgage applications. This parameter gives the idea of the risk involved in the mortgage. Before learning about the relation between LVR and mortgage rates let us first find out what LVR is.

LVR = loan amount/value of property

Suppose the value 80%of the property you want to mortgage is $500,000 and you pay $100,000 as a down payment and want to take a loan of $400,000. Then in this case LVR is 80%.

LVR gives the idea about the risk profile of a mortgage. Higher LVR means higher risk.

When LVR is less than 80% mortgage rate may come down. And if LVR is lower than 80% borrowers may have to pay higher mortgage rates along with the Lender’s mortgage insurance which further increases the overall cost of borrowing.

Mortgage term

The mortgage term is the time a borrower takes to repay the loan. Mortgages with shorter terms have lower mortgage rates and less overall cost. Short mortgage terms mean monthly installments are higher. And mortgage with loner mortgage terms has a higher interest rate. Such a mortgage is more affordable as the monthly installment amount is less but the overall cost mortgage will be higher in the long run.

Debt to income ratio

The debt-to-income ratio is the ratio of total debts to the gross income of the borrower. e.g., if your yearly income is $50,000 and your total (including all debt from all sources like a credit card, mortgage, car loan, etc.) unpaid debt of 60,000$, your debt-to-income ratio will be 60,000/50,000 i.e., 1.2. It means that your debt is 1.2 times your annual income.

A debt-to-income ratio above 6 can be problematic to get a mortgage. Applications with higher debt-to-income ratio may get rejected or mortgages may be approved with higher mortgage rates.

Mortgage type

Different types of mortgages like conventional mortgages, Jumbo mortgages, and government-backed mortgages like VA, USDA, FHA, etc. have widely different mortgage rates. Each type of loan has its own terms and conditions. To learn more about types of mortgages you can visit this article on mortgages.

Loan Size

As the size of the loan amount increases, mortgage rates also increase because it is difficult for lenders to sell the loan in the secondary market as a large loan amount poses a higher risk to the lender. Also, if the loan amount is too low then mortgage rates tend to be higher as there is a certain fixed cost associated with mortgaging regardless of the size of the loan.

FAQs

If you research this question from an economic point of view, it is a very vast topic. However, the best time to mortgage a property is determined by your own financial condition and affordability.

- Do not try to time the market. Focus on your affordability.

- Winters are usually a better time to buy a home in the United States as per previous years’ records. Sellers are ready to negotiate more during winter because of lower demand in winter. You can also inspect the heating system and other interiors of the home more effectively during winter. Also, it is a general trend that the beginning of the month witnesses higher applications, and the end of the month witnesses higher closure of the deals. So, it is better to contact lenders earlier in the month to get most of their attention. However, you can always check and keep applying.

- Your credit score is not fixed. It keeps on fluctuating based on your credit card activity, debt, your regular installment payment history, etc. So, it is better to take some time and try to improve your credit score, if possible, to get a mortgage on the best terms.

- The best time to mortgage a property is when you manage to have a stable income for at least two years and have debt to income ratio above 43%.

As a consumer, it’s your right to negotiate for the best possible terms with your lender. You can negotiate better when rates are high because of declining demand in the market. You may be able to secure better prices and a longer closing period.

Mortgage rates vary from time to time and from area to area. They are also subjected to your financial condition which is unique to you. You can use free mortgage online calculators to get a general idea of mortgage rates in the market. Once you get that average figure in mind, you can start approaching various lenders to get their quotes. Now, you can compare these quotes.

Important Tip: Make sure to compare APR, not the interest rates. Because APR is a true indicator of the actual cost you have to pay for your mortgage.

If you have difficulty or do not know much about mortgaging, then you should first consider learning some basics of mortgaging. You can refer to our article https://markethulk.com/index.php/2023/08/27/mortgage-in-usa-in-2023/.

If you are still facing difficulty then you contact the nearest banks or mortgage brokers. Mortgage brokers may help you get the work done. You can approach them with the help of your real estate agent also. But make sure to go to reputed brokers only. You should do thorough research about them before approaching. You can read their online reviews and verify their license online to avoid any scams which are quite common these days.

Yes, you may witness differences in mortgage rates from one state to another. The difference may be as high as 1% for the same terms and financial condition of the borrower. States like California may offer lower mortgage interest rates pertaining to higher competition. Competition lowers the margin of lenders facilitating lower mortgage rates to borrowers.

Various other factors like operation cost, local laws like foreclosure rules, etc. affect the mortgage rates. States with strict foreclosure laws witness higher mortgage rates. The states with higher average salaries have higher mortgage rates because after all lenders merge their operational costs with the interest rates.

There is no direct control over mortgage rates by any agency. However, the United States Federal Reserve’s monetary policy has the biggest impact on mortgage rates. Though the FED does not control mortgage rates directly, it can alter demand and supply in the market thus controlling the mortgage rates indirectly.

In order to avoid mortgage fraud, you should only deal with the reputed and licensed professionals only. Make sure to verify their license and reviews online. It is always advisable to contact brokers or lenders by referrals from friends who already have used their services. Always be alert about unsolicited loan offers that claim to reduce downpayment requirements or lower mortgage rates on payment of service charges. Also keep in mind that extraordinary offers come at a price e.g., some real estate agents may offer zero down payment options luring you to buy properties you actually cannot afford. Such type of offer may lure you to sign the deal on terms that may be extremely unfavorable in the long term.