A very solid foundation of financial concepts is a must to live a prosperous life and create wealth. In this article, we have discussed 5 finance lessons that can help you understand finance and wealth management from a completely different perspective.

Lifestyle Creep Can Cripple You

Lifestyle creep is the relative motion between your income growth and the growth of your expenses. It is also referred to as lifestyle inflation. All of us want a better lifestyle whatever financial situation we might be in. To achieve it you endeavor at your best. Even if you succeed in maintaining good growth in income but cannot control your expenses, you end up being poor. Let’s understand lifestyle inflation with the help of an illustration:

Assuming a monthly income of $5000. As per the 50:30:20 rule bifurcation of this income will be:

Needs: $2500

Wants: $1500

Investments: $1000

Now suppose your monthly rises by 25% to $6250. Now if you keep your expenses the same as earlier, your investments will be increased. The new bifurcation will look like this:

Needs: $2500

Wants: $1500

Investments: $1000 + $1250 = $2250 which is 2.5 times your earlier saving.

But in reality, it is much more difficult to channel your increased income to the savings. Rather you are more tempted to spend unnecessarily if have more money available in your checking account.

However, with uncontrolled lifestyle creep, this distribution looks like:

Needs: $2500

Wants: $1500+ $1000

Investments: $1000+ $250

In the above example, we witnessed a 25% increase in savings along with a 28.5% increase in overall expenses and a 66.7% increase in expenses in the wants category.

Thus, lifestyle creep or lifestyle inflation in the above case has reduced the scope of saving from 250% to 25%. Though effects are not significant in the short term they can significantly affect your portfolio in the long run. So, your first finance lesson is to keep check on lifestyle creep. But how?

What can you do to control lifestyle creep?

Budgeting

Budgeting is a helpful tool to analyze your expenses in a logical manner. It presents a very clear picture of your category-wise expenses, which areas you are spending more, and in which areas there is scope for cost-cutting. You can follow this article to learn more about budgeting.

Make long-term investments

Making long-term investments and analyzing them regularly can really help to cope with lifestyle creep. You can consider increasing your budget for long-term investment options like CDs, bonds, mutual funds, ETFs, etc. every time you are given a salary hike. This way funds in your checking account will be reduced and ultimately control your urge to spend more.

Plan a new investment with increased income

With every income hike, you can also plan a contribution to a new fund like an emergency fund. You can also start saving early for retirement or child’s education or any envisaged expense of significant cost. Also, remember to create every fund in different asset classes to bring diversification and mitigate the risk of your portfolio.

Wealth Creation is All About Time

It is extremely important to have long-term goals. They not only keep you focused but also help in avoiding noise and turbulences in the economy. Predicting the economy for the short term is a very difficult task but as we increase the time frame of an investment, they are much less easy to predict and more often follow certain rules and fixed economic patterns.

Also, the magic of compound interest also speeds up with time. Return on investment is not a linear function of time. It can generate exponential return, only condition is that you have to stick to it for a longer time frame.

Compounding Can Lead to Extraordinary Outcomes

Compound interest can lead to extraordinary returns because of interest paid on incremental principal value. By incremental principal value, I mean every time interest is given, it adds up to your invested value so that when the next time interest is calculated, it will be calculated on principal value plus previously earned interest rate. To understand it more effectively let’s understand it with the help of a pay graph.

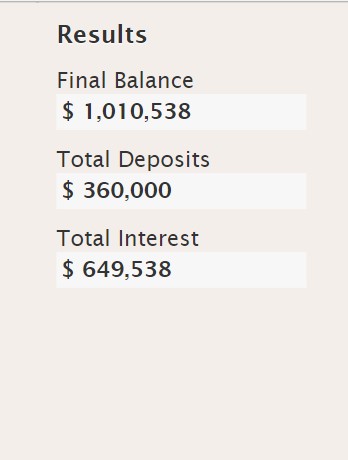

Assuming you make a monthly investment of $1000 which is invested at an average interest rate of 6% for 30 years then the result will look like this:

You may be surprised to note that the interest component of the 30th year is $649,537 which is even more than the total invested amount i.e., $360,000. But despite being on the most basic finance lessons, people are not able to harness its power.

Skill is the Best Investment

You may not be able to generate good returns, even not able to fight inflation, or may fall into a debt trap. These financial situations are part and parcels of life. No one expects a smooth and linear trajectory of financial growth. The only thing that will support you in such situations is your own self-confidence and skills. Investment in your own self is the best investment of all.

So, keep learning new skills that will not only boost your personality and self-confidence but also have the potential to create a new income stream in the future. I would suggest making informed decisions before starting to learn a new skill. Give priority to those skills that are expected to be more valuable in upcoming years like AI, data science, crypto technology, etc. These are just examples; you can make your own selection depending on your profession.

Money is Your Best Friend and Worst Enemy

Just like you make budgeting for your financial expenses and income. In the same way, you should plan a more comprehensive budget that not only includes your finances but also other important aspects of your life like health, relationships, rejuvenations, etc. After all purpose of money is only to achieve health and happiness. In pursuit of material goals never compromise with your health, family, and friends. “Even wealthy people can get depressed the same way people living in poverty”- Psychcentral

Your definition of wealth must include: time, network, wisdom, health and money. Take regular time out for recreational activities and always consider “money” as one of the important aspects of life and not everything.